A robust verifiable credit scoring mechanism is the backbone of prudent lending. Especially in the case of NBFCs with the target audience mostly not having a credit history, it becomes increasingly difficult to discern the earnest borrower from the crowd.

And adding the latest RBI mandate to maintain a credit scoring methodology, it has become almost inevitable for NBFCs to delve into advanced analytics.

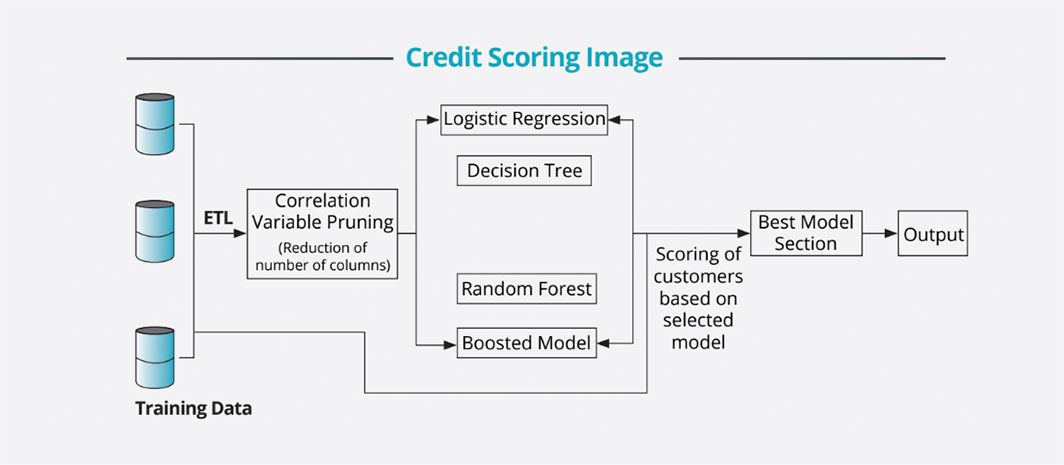

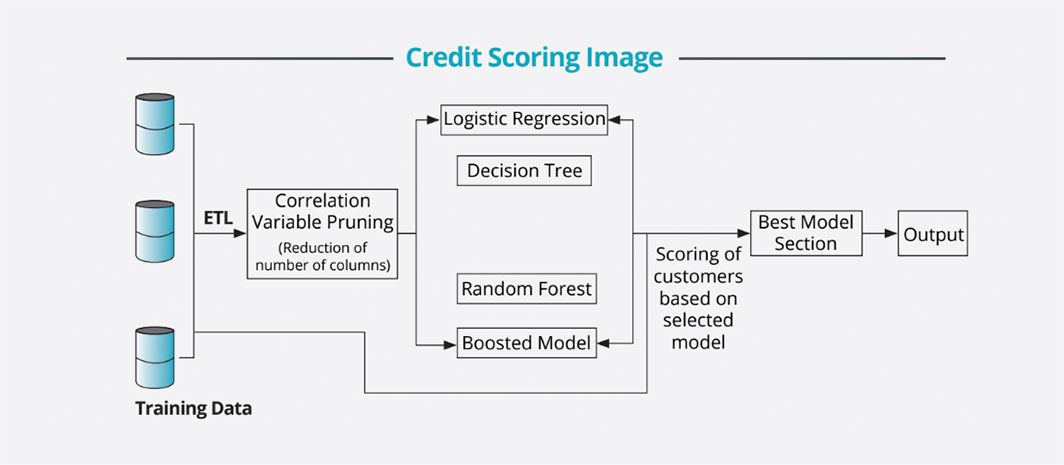

Pull in raw data to train and implement the credit scoring model from your ERP and CRM. Other data sources, as per your preferences may be defined. This data consists of a host of columns gathering customer information, including balances maintained by the applicant, duration of credit, previous credits’ status, purpose of loan and so on.

The more information that is available, the better the accuracy the model.

Run this through a correlation to reduce the crowd - which basically means getting rid of the columns which rise and fall with the same intensity. For example, occupation nd monthly salary would mostly have a high correlation, one of them would generally be dropped to make the algorithm simpler and improve accuracy.

Oversample to account for far fewer ‘non-creditworthy’ past applicants.

Run analytical models like Logistic Regression, Decision Tree, Random Forest and Boosted Models and compare the results. Select the model which is best fit.

Test the results on a different data subset for Feasibility.

You can now feed live data into the model and compute a credit score!