November 8, 2016, will remain etched in the memory of every Indian. The launch of demonetization by the Indian government changed the face of our financial sector forever. Cancellation of Rs 1000 and Rs 500 notes and the unavailability of newer denominations forced the population to reduce their dependence on cash transactions and go digital. The transition, which in any other circumstance would have taken years, happened in a fortnight. Since then, digital transactions have witnessed massive growth, especially with the government and banking regulators striving to make India a cash-independent economy in the coming decade.

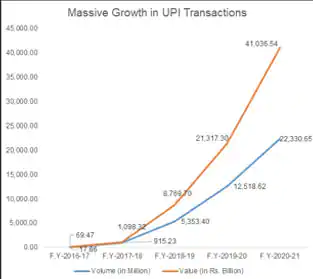

The government’s push towards the digital economy has opened the doors for various startups such as Paytm, Google Pay, Phone Pe, Amazon Pay, etc. These startups use Unified Payment Interface (UPI) technology as their base to transfer money digitally. As per the National Payments Corporation of India, transactions made through UPI stand at Rs 7.7 Lakh Crores. From street-side vegetable vendors to big grocery stores, everyone has jumped on the bandwagon of digital transactions, even if it’s for a meager amount.

Chart Courtesy: https://www.npci.org.in

While the rise in digital transactions is great for the economy, it has also increased the occurrences of digital crime. As per industry reports, suspected digital fraud has risen by 89% when comparing the last 4 months of 2020 with the first 4 months of 2021. With millions of digital transactions happening every day, the government has put its focus on increasing digital security to counter fraud.

The government, in tandem with RBI, has mandated all banks, fintech companies, and payment apps to offer secure network gateways for transactions, as well as raise awareness on various kinds of digital frauds and how one can prevent them.

The popularity of digital transactions doesn’t mean that Indians have discarded cash. It is still the king with over Rs 29 trillion of currency in circulation as of November 2021, 65% up by the pre-demonetization era. Yet, it doesn’t hold the charm anymore. People in cities and villages, millennials and baby boomers — all are finding it easier, safer, and more convenient to transact digitally. The COVID-19 pandemic also created an urge among people to migrate towards contactless online transactions, as it was the need of the hour.

Demonetization paved the way for Indians to usher in a new era of digital. The ease of using smartphones, along with better network connectivity in far regions, empowered people to take on the journey of contactless transactions. It is not uncommon to find people with more digital transaction apps on their phones and less cash in their wallets, signifying the importance of demonetization in making India a lesser cash-based economy.

With the increase in digital transactions the increase in security concerns are increasing. To know more about securing your digital transactions, reach out to our security experts https://www.teamcomputers.com/information-cyber-it-security